Starting on the journey of acquiring your own business is both thrilling and challenging. Amidst the many decisions you’ll make, selecting the right business structure emerges as a crucial foundation for your enterprise. It not only influences how you operate your business but also plays a vital role in safeguarding your personal assets, managing taxes, and defining the overall structure of your venture.

Let’s delve into the importance of promoting business formations like Limited Liability Companies (LLCs) to ensure you kickstart your business on the right note.

Understanding Business Structures:

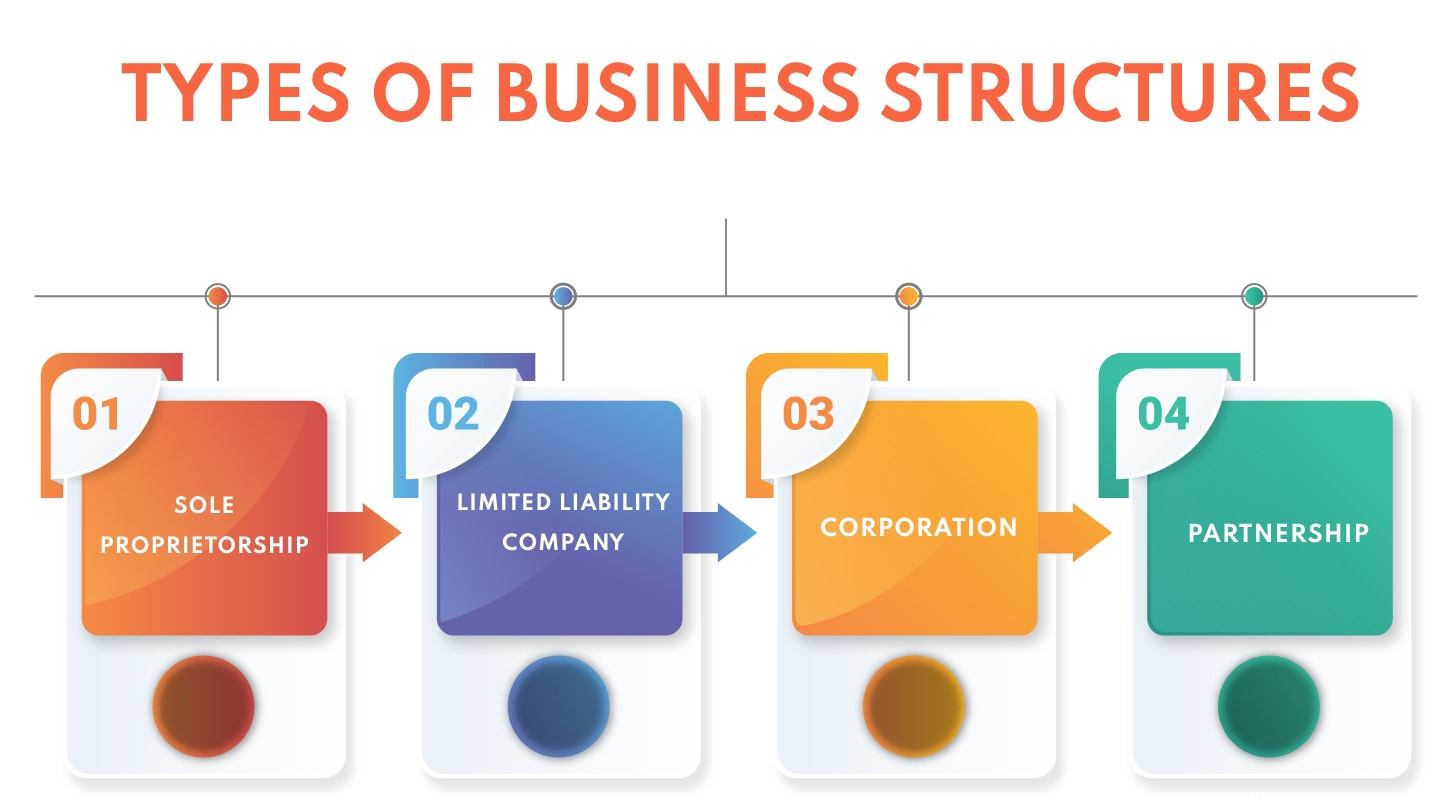

Before exploring the benefits of the LLC option, let’s briefly touch on the most common types of business structures:

- Sole Proprietorship: Simple and owned by one person, but personal liability is a concern

- Limited Liability Company (LLC): A mix of flexibility and liability protection, making it a popular choice for small businesses.

- Corporation: A separate legal entity with limited liability but comes with increased regulations and taxes.

- Partnership: Multiple owners sharing profits and losses, but individual responsibility remains.

Benefits of Forming an LLC:

- Limited Liability Protection: One of the distinct advantages of an LLC is the shield it provides for personal property. Your home and savings are generally protected from business loans and payments.

- Flexibility in Management: The LLC provides a flexible management structure. Choose to manage the business yourself or hire managers based on your preferences and business needs.

- Pass-through Taxes: Avoid double taxation. Profits and losses go to individual members, resulting in potential tax benefits for small businesses.

- Reduced Administrative Burden: Enjoy fewer formalities and reporting requirements than corporations, reducing administrative burdens and associated costs.

- Enhanced Credibility: Operating as an LLC increases the credibility of your business. It signals professionalism and a commitment to legal and financial responsibility.

Steps to Creating an LLC:

Now, let’s break down the steps of creating an LLC clearly and concisely:

- Choose a Business Name: Choose a unique and available name that complies with state laws.

- File Articles of Organization: Prepare and file the required legal documents, often called articles of organization, with the state agency.

- Create an Operating Agreement: While not always necessary, an Operating Agreement is advisable. It describes ownership, management, and operational processes.

- Obtain Necessary Licenses and Permits: Check and secure industry-specific permits and licenses required to operate legally.

- Apply for an EIN: Obtain an Employer Identification Number (EIN) and open a business bank account from the IRS for tax purposes.

- Open a Business Bank Account: Separate business and personal finances by opening a dedicated business bank account.

Starting a business is a significant venture, and the right business structure sets the stage for long-term success. By advocating the creation of an LLC, you strike a balance between liability protection, flexibility, and tax advantages. Following these steps to form an LLC lays a solid foundation for meeting legal requirements, minimizing potential risks. Remember that consulting legal and financial professionals can provide personalized guidance based on your specific business needs and goals.

Need help forming your business? Contact us today! Book online here or call our office number at 760-754-9059.

0 Comments