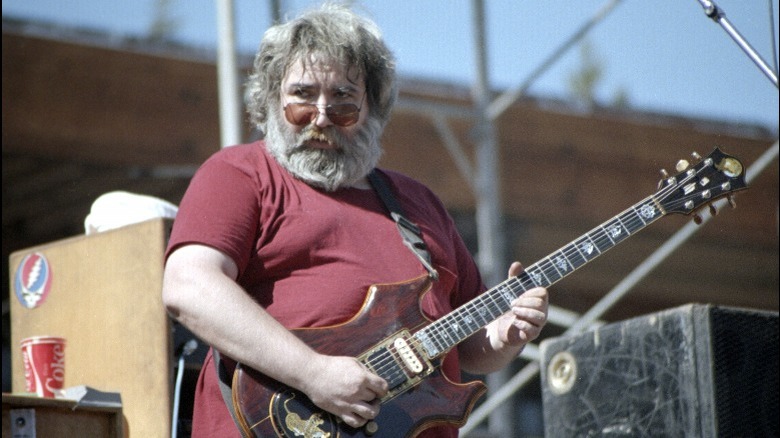

Jerry Garcia’s Probate Nightmare

Jerry Garcia, the legendary frontman of the Grateful Dead, left behind more than iconic music. He also left his heirs entangled in a 9-year legal battle over his estate, which was filled with claims, disputes, and costly probate fees. Valued at $15 million, Jerry Garcia’s Probate Nightmare faced $50 million in claims. However, this chaos could have been avoided with proper estate planning tools, like a living trust. While Garcia’s situation was unique, it highlights the need for comprehensive estate planning for everyone, no matter the size or complexity of the estate.

What Went Wrong with Jerry Garcia’s Estate?

Garcia’s case serves as a prime example of poor estate planning. Several issues contributed to the long probate battle:

- Multiple ex-wives and children: Garcia had several family members who competed for a share of his estate. His second wife demanded $250,000 in annual support, while his daughter argued she deserved more.

- Ownership disputes: Garcia intended to leave four of his guitars to his guitar maker, but the other members of the Grateful Dead claimed those guitars belonged to the band.

- Overwhelming creditor claims: Garcia’s chaotic financial management and drug addiction left his estate vulnerable to creditors.

Though his third wife successfully reduced the claims to $700,000, the prolonged probate process drained time, energy, and resources from Garcia’s heirs.

How Could a Living Trust Have Helped?

A living trust would have spared Garcia’s heirs years of legal challenges and ensured his wishes were honored. Here’s why having a living trust matters:

- Avoid Lengthy Probate

Probate is the legal process of distributing an estate, and it is often long, costly, and public. A living trust allows your estate to bypass probate entirely. As a result, your heirs receive their inheritance faster, without extra expenses or delays.

- Keep Your Affairs Private

Since probate is public, anyone can access the details of your estate. However, a living trust keeps asset distribution private. This not only shields your family from unwanted attention but also reduces the chances of disputes.

- Ensure Clear Asset Distribution

A well-drafted living trust eliminates confusion about how your assets should be divided. For Garcia, this could have resolved the dispute over his guitars without interference from his bandmates.

- Protect Your Estate from Creditors

Creditors can file claims against an estate during probate. A living trust helps protect your assets by placing them in the trust while you’re alive, making it harder for creditors to seize them.

- Maintain Flexibility

A living trust remains flexible and revocable during your lifetime, meaning you can make changes as circumstances evolve. Whether you go through a divorce or have children, you can adjust the trust to reflect your new situation.

Why a Living Trust is Essential for Everyone

You don’t have to be a rock star to benefit from a living trust. If you own a home, have savings, or possess valuable assets, a living trust ensures your loved ones are protected. Here’s why it’s important for everyone:

- Prevent Family Conflicts: Just like Garcia’s heirs, your family may end up in disagreements over your estate. A living trust clearly communicates your intentions, helping to avoid these disputes.

- Minimize Estate Taxes: In some cases, a living trust can reduce estate taxes, allowing your heirs to inherit more of your assets.

- Simplify the Process for Your Heirs: Probate can take months or even years. A living trust guarantees your heirs receive their inheritance quickly, without the added stress of legal proceedings.

Plan Ahead to Protect Your Legacy

Jerry Garcia’s probate nightmare teaches a valuable lesson about the dangers of neglecting estate planning. By establishing a living trust, you can protect your assets, spare your family unnecessary grief, and ensure your legacy is preserved according to your wishes.

Don’t wait until it’s too late—start planning today and take control of your future with a living trust.

Call us at 760-754-9059 or click here to book an appointment and speak with one of our experienced estate planning professionals.

0 Comments