Why Estate Planning Should Never Be a DIY Project

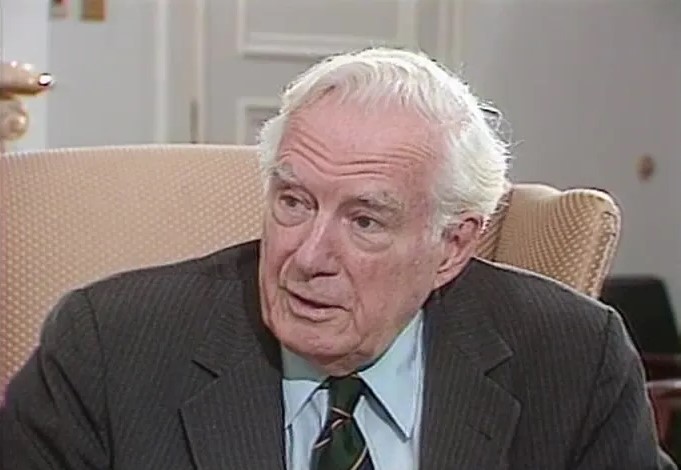

When a former Chief Justice of the United States passes away, their estate plan often faces intense scrutiny. This was certainly true for Chief Justice Warren Burger, who died in 1995. What captured attention wasn’t just his legal legacy but also his estate plan—or rather, the lack of one.

The Surprising Strategy Behind Chief Justice Burger’s Will

Warren Burger’s will, which was brief and personally typed, drew significant criticism. At just 176 words, it seemed incredibly short for someone of his prominence. Critics quickly highlighted the will’s failure to address estate tax issues on his $1.8 million estate. Given that the estate tax exemption was $600,000 at that time, a large portion of Burger’s estate faced taxation.

However, a closer look reveals a more nuanced strategy. The key was actually the will of his predeceased wife, Elvera Burger. Her will had effectively used her estate tax exemption to transfer a substantial amount directly to their children. Consequently, this move bypassed Warren Burger and strategically utilized both their exemptions, minimizing the tax burden on their combined estates. What initially appeared as a minimalist will was, in fact, part of a larger, well-coordinated estate planning strategy.

The Risks of DIY Estate Planning

Despite the apparent strategy, estate planning is not a task for amateurs. Engaging in DIY estate planning can lead to significant problems, such as:

- Invalid Documents: For instance, an unwitnessed or improperly drafted will may be deemed invalid by probate court. This can leave asset distribution up to state laws, which may not reflect your wishes.

- Unforeseen Consequences: Additionally, without professional guidance, technicalities and legal nuances can result in unintended outcomes.

Why Professional Estate Planning Matters

- Avoid Mistakes: Professional estate planners ensure that your documents meet all legal requirements, including proper witnessing and compliance with state laws.

- Customize Your Plan: Every individual’s financial situation is unique. Therefore, experts can help tailor your plan to navigate complex tax laws and protect your assets.

- Reduce Taxes and Fees: Effective planning can significantly lower taxes and probate fees. As demonstrated by the Burgers, strategic use of exemptions can reduce tax burdens.

- Adapt to Changes: Since life is unpredictable, regular updates to your estate plan are crucial. This ensures that your plan remains effective amidst changes in laws, finances, or personal circumstances.

The Document People’s Approach

At The Document People, we understand the importance of a well-crafted estate plan. Our legal document preparation services provide a cost-effective alternative to traditional attorney services. We work closely with clients to create comprehensive and valid estate planning documents. By doing so, we help you avoid common pitfalls and ensure that your wishes are honored.

Take Control of Your Future

Given the high stakes in estate planning, avoiding DIY risks is essential. Relying on experienced professionals ensures that your plan is executed as intended. Remember, “An ounce of prevention is worth a pound of cure.” Secure your legacy and protect your loved ones with a meticulously crafted estate plan.

Don’t wait until it’s too late—start planning today and take control of your future with a living trust.

Call us at 760-754-9059 or click here to book an appointment and speak with one of our experienced estate planning professionals.

0 Comments